Local News

Minnesota Senator, whose daughter relies on EpiPens, criticizes company’s outrageous price hikes

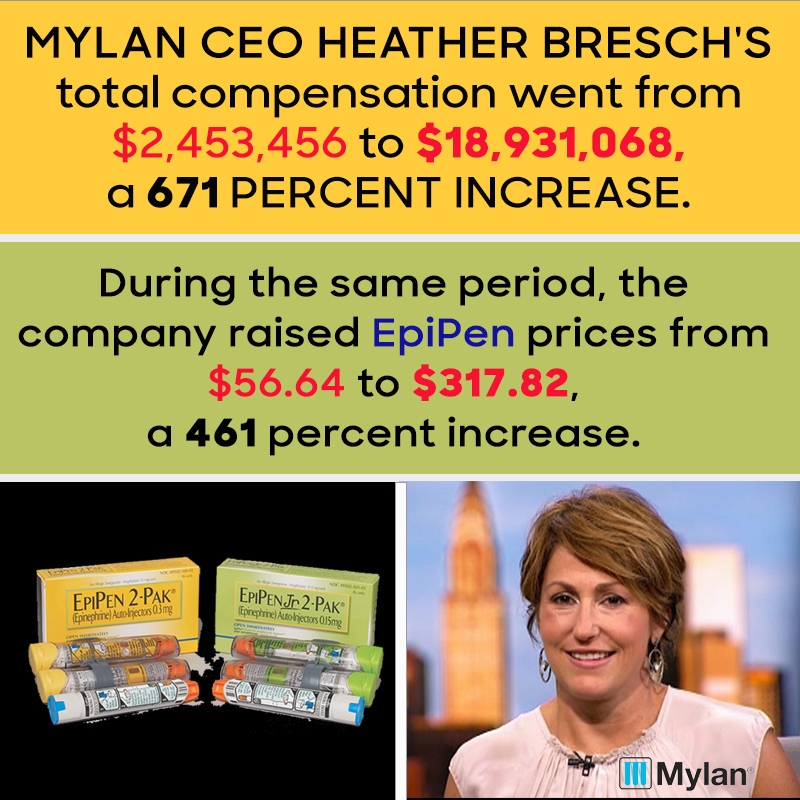

CEO got a 671% raise, while drug increased in price by 461%

MINNEAPOLIS — U.S. Sen. Amy Klobuchar has criticized the sharp price hikes for EpiPens, the emergency drug injectors for severe allergic reactions, saying it’s outrageous that the manufacturer is making money off the backs of kids and adults who have few alternatives.

A two-pack has risen from about $100 in 2008 to as much as $600 today. The Minnesota Democrat says there’s no way that drug-maker Mylan can justify such steep increases.

Klobuchar was joined at a news conference at Children’s Hospital in Minneapolis on Wednesday by pediatricians who denounced the price increases as unconscionable.

Klobuchar stated in part: “I write to request the Federal Trade Commission (FTC) investigate whether Mylan Pharmaceuticals has violated the antitrust laws regarding the sale of its epinephrine auto-injector, EpiPen. Many Americans, including my own daughter, rely on this life-saving product to treat severe allergic reactions.”

But the price of the EpiPen itself is just one of many controversies tied to Mylan and the company’s CEO, Heather Bresch, who received a 671-percent raise from $2.5 million to $18.9 million between 2007 and 2015.

Bresch is also the daughter of U.S. Democratic Sen. from West Virginia, Joe Manchin.

Manchin, the Washington Post wrote, is not a member of the Senate Judiciary Committee, which has shown the most interest in probing Mylan’s pricing practices, and so far the senator is not discussing the issue.

“Right now we don’t have any comment,” Manchin spokesman Jon Kott said in an email to the Post on Tuesday.

In 2013, Congress passed a law using grant money for schools to stock EpiPens. Some states require them in schools, including West Virginia, where Bresch’s mother, Gayle Manchin, was head of the Board of Education when the policy went into effect.

How Bresch attained her position at Mylan looks controversial as well, another Post article wrote.

“The most scandalous incident occurred in 2008 shortly after she was named the company’s chief executive and involved the master’s degree in business administration from West Virginia University that was listed on her resume. It turns out she never got it. An investigation by the school, prompted by a newspaper report, found that some administrators had added courses and grades to her transcript to make it look as if she had completed the required coursework.

The incident made headlines across the state because her father was governor at the time and the school’s president, Mike Garrison, was a longtime family friend and former business associate.

If that’s not bad enough, “Mylan is one of the leading exploiters of the technique known as inversion, in which a U.S. company cuts its tax bill by acquiring a foreign firm and moving its tax domicile to the acquired company’s homeland, stated the L.A. Times.

“Mylan’s 2014 deal involved its buying a generics manufacturer from Abbott Laboratories and reincorporating in the Netherlands, the subsidiary’s home. As in all inversions, nothing else changed: Mylan’s operational headquarters remained in Pennsylvania, and its main workforce didn’t relocate. At one point, Mylan even appealed to U.S. antitrust officials to help it block a takeover bid from an Israeli company. But the deal did allow the firm to cut its U.S. tax bill.”