Local News

Gov. Walker stops in Onalaska, to sign election-year child tax rebate, tax holiday

Gov. Scott Walker surrounded himself with kids at Kohl’s in Onalaska on Tuesday to sign his child tax credit and tax holiday bills.

Earlier this year, Walker proposed the $100 per-child tax credit as a way of refunding surplus money. The governor said families can sign up for the rebates between May 15 and July 2.

Walker, who is seeking re-election, toured the Wisconsin — also hitting Waukesha, Ashwaubenon and Menomonie — to authorize the sales tax holiday for the first five days of August, along with the child credit.

Walker used his veto to expand the tax holiday to Aug. 1-5, as well as make the $100 credit available to any family that claims a child. To qualify, a child must have been under age 18 for all of 2017, be a resident of Wisconsin as of Dec. 31 and be a U.S. citizen.

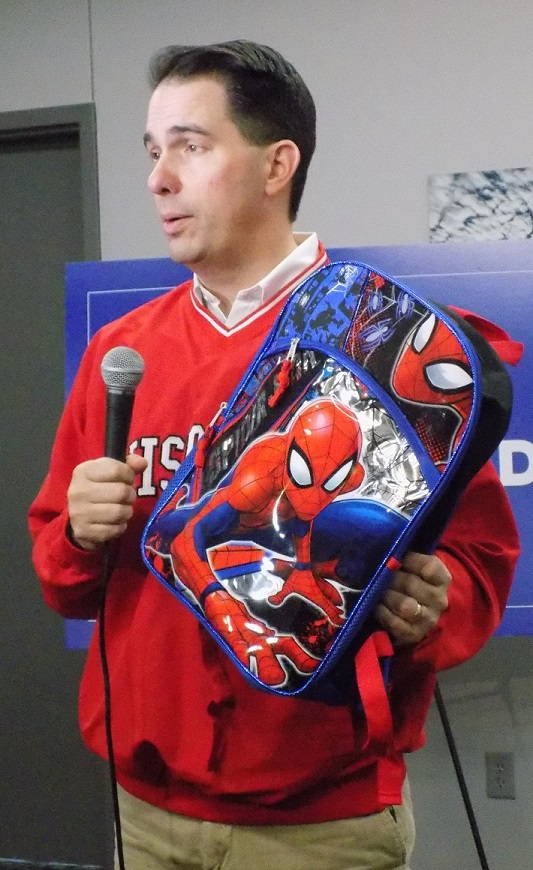

Back in January, Walker stopped at the La Crosse Airport, holding a Spider-Man backpack, while promoting the child tax credit idea, which will cost the state $122 million.

At that time he said, “What parents tell me overwhelmingly, is they’re already making plans for how they would spend that — on school supplies, backpacks, on paper and crayons, and pens and pencils, on new shoes and clothing, and other things along the way.”.

Tuesday, Walker said the rebate will be a “big deal” for many Wisconsin families.

The state Department of Revenue website to sign up for the child tax credit has has not yet launched. Families will receive their rebate checks later in the summer — just a few months before the November election.

Democrats have repeatedly called out Walker on the measure, as basically bribing voters as Walker seeks a third term.

“Instead of one-time campaign gimmicks and massive tax giveaways to the wealthy, we should be investing in long-term child care relief, expanding access to affordable health care and supporting strong community schools,” Senate Minority Leader Jennifer Shilling of La Crosse said.

Critics of sales tax holidays, particularly retailers, argue they are costly and difficult to administer.

The sales tax will be waived on pieces of clothing costing less than $75, a computer costing less than $750, computer supplies costing less than $250 and school supplies costing no more than $75 per item.

In 2017, 16 states had some type of sales tax holiday, according to the Federation of Tax Administrators.

The website to sign up for the child tax rebate, which will launch in a couple days, is childtaxrebate.wi.gov. Those without internet access can call 608.266.5437.