Politics

La Crosse County Board chair happy two road-funding questions passed

Two advisory referendums in La Crosse County to fund roads received over 50 percent of the vote, while two others did not.

Increasing short-term borrowing (73.8 percent no) and enacting a $56 wheel tax (68.4 percent no) were voted down.

A county investment of $5 million a year (78 percent said yes) and a Premier Resort Area Tax (PRAT) given the OK (68.2 percent said yes). It was the second time in 1.5 years the county said yes to the PRAT. Last referendum received 55 percent of the yes vote.

The PRAT is basically a half-percent tax on just about anything sold in the county.

Here’s the 16-page document on what the PRAT is and covers, exactly. Here’s how it was worded on the ballot:

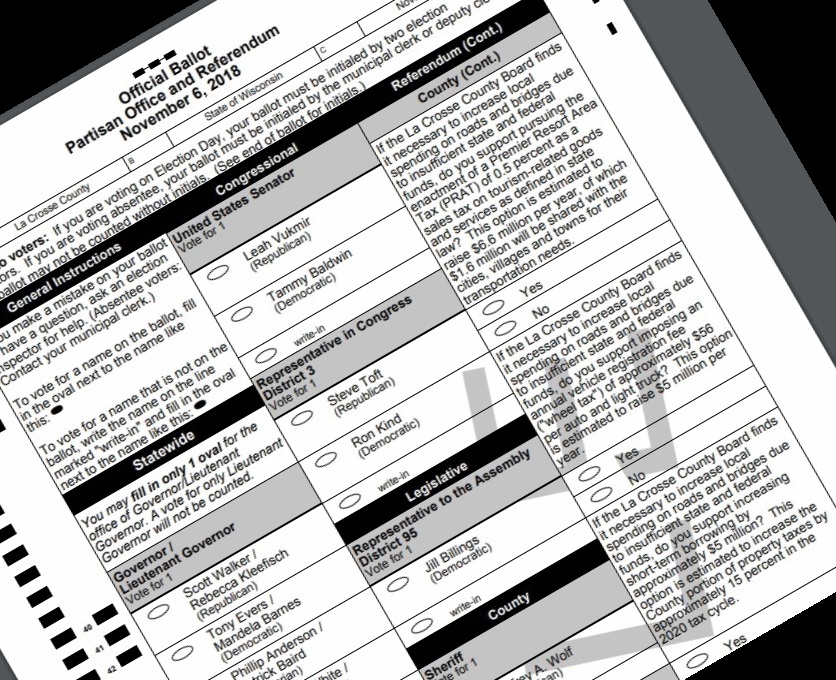

If the La Crosse County Board finds it necessary to increase local spending on roads and bridges due to insufficient state and federal funds, do you support pursuing the enactment of a Premier Resort Area Tax (PRAT) of 0.5 percent as a sales tax on tourism-related goods and services as defined in state law? This option is estimated to raise $6.6 million per year, of which $1.6 million will be shared with the cities, villages and towns for their transportation needs.

County Board chair Tara Johnson said opponents of the PRAT had dismissed the first approval in a referendum last year as sort of a fluke.

“There were definitely some folks who said, ‘Oh in April of ’17 it was spring election, low voter numbers, it doesn’t really have a valid weight to it.'” Johnson said.

The La Crosse Area Chamber of Commerce concluded wrote it would cost families — not tourists — $105 per year and that 74 percent of that $6.6 million in funding would come from county residents. Below is a list (from that 16-page document) of businesses it would affect.

Johnson said fellow county supervisor Steve Doyle is ready to re-introduce the PRAT plan in the legislature.

Madison has to give its approval before the county could put such a tax on local businesses into effect.

5311 – Department stores

5331 – Variety stores

5399 – Miscellaneous general merchandise stores

5441 – Candy, nut and confectionery stores

5451 – Dairy product stores

5461 – Retail bakeries

5499 – Miscellaneous food stores

5541 – Gasoline service stations

5611 – Men’s and boys’ clothing and accessory stores

5621 – Women’s clothing stores

5632 – Women’s accessory and specialty stores

5641 – Children’s and infants’ wear stores

5651 – Family clothing stores

5661 – Shoe stores

5699 – Miscellaneous apparel and accessory stores

5812 – Eating places

5813 – Drinking places

5912 – Drug stores and proprietary stores

5921 – Liquor stores

5941 – Sporting goods stores and bicycle shops

5942 – Bookstores

5943 – Stationery stores

5944 – Jewelry stores

5945 – Hobby, toy, and game shops

5946 – Camera and photographic supply stores

5947 – Gift, novelty and souvenir shops

5948 – Luggage and leather goods stores

5949 – Sewing, needlework, and piece goods stores

5992 – Florists

5993 – Tobacco stores and stands

5994 – News dealers and newsstands

5999 – Miscellaneous retail stores

7011 – Hotels and motels

7032 – Sporting and recreational camps

7033 – Recreational vehicle parks and campsites

7922 – Theatrical producers (except motion picture) and miscellaneous theatrical services

7929 – Bands, orchestras, actors, and other entertainers and entertainment groups

7948 – Racing, including track operation

7991 – Physical fitness facilities

7992 – Public golf courses

7993 – Coin-operated amusement devices

7996 – Amusement parks

7997 – Membership sports and recreation clubs

7999 – Amusement and recreational services, not elsewhere classified