Politics

UW-L’s Heim doesn’t see “resort” sales tax getting through legislature, but also doesn’t think it was a fluke voters passed it

One political expert in La Crosse doesn’t hold out much hope for La Crosse County getting its Premier Resort Area Tax (PRAT).

The concept of a PRAT, which would be a half-percent sales tax collected from most local businesses, has been approved on county referendums two consecutive years.

Joe Heim, political scientist at the University of Wisconsin-La Crosse, however, said on Thursday on WIZM that Republicans who run the legislature probably won’t like the idea.

“I think you have to be honest, getting through the state legislature, a new tax, I question whether that’s ever going to happen,” Heim told Mike Hayes.

Heim also doesn’t think that it passing two referendums in the county is a fluke.

“People have had two shots at this on the ballot,” Heim said, “and the second time around, they actually voted an even higher number than the first time.

“So I don’t think you can assume there’s some kind of ignorance out there.”

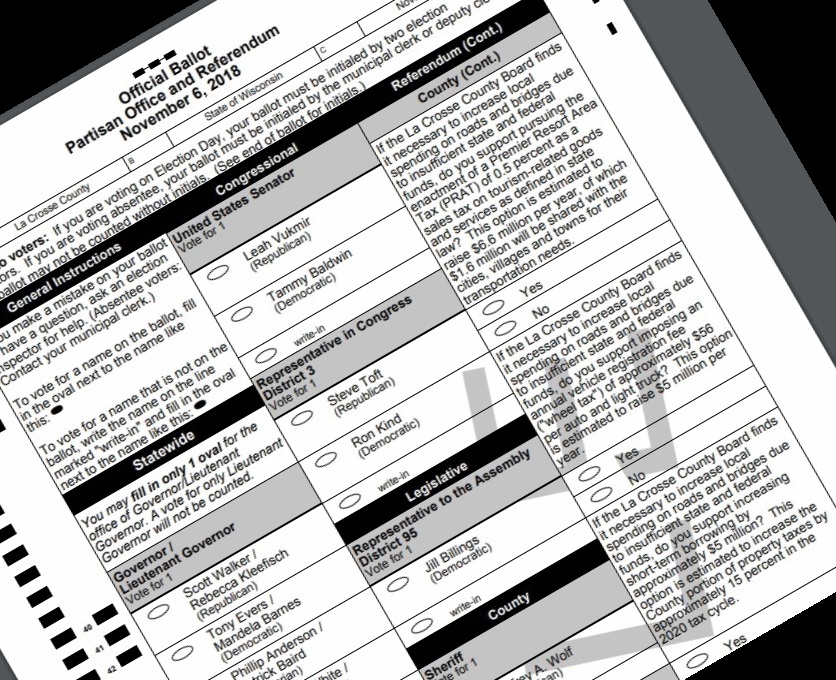

The wording on both referendums for the PRAT was exactly the same and as follows:

If the La Crosse County Board finds it necessary to increase local spending on roads and bridges due to insufficient state and federal funds, do you support pursuing the enactment of a Premier Resort Area Tax (PRAT) of 0.5 percent as a sales tax on tourism-related goods and services as defined in state law? This option is estimated to raise $6.6 million per year, of which $1.6 million will be shared with the cities, villages and towns for their transportation needs.

Of the four road-funding questions on the November referendum, along with the PRAT getting 68.2 percent of the yes votes, also passing with 78 percent was a county investment of $5 million a year. The PRAT received 55 percent of the yes vote in a referendum a year and a half ago.

Here’s the 16-page document on what the PRAT is and covers, exactly. Below is a list of of businesses it would affect.

5311 – Department stores

5331 – Variety stores

5399 – Miscellaneous general merchandise stores

5441 – Candy, nut and confectionery stores

5451 – Dairy product stores

5461 – Retail bakeries

5499 – Miscellaneous food stores

5541 – Gasoline service stations

5611 – Men’s and boys’ clothing and accessory stores

5621 – Women’s clothing stores

5632 – Women’s accessory and specialty stores

5641 – Children’s and infants’ wear stores

5651 – Family clothing stores

5661 – Shoe stores

5699 – Miscellaneous apparel and accessory stores

5812 – Eating places

5813 – Drinking places

5912 – Drug stores and proprietary stores

5921 – Liquor stores

5941 – Sporting goods stores and bicycle shops

5942 – Bookstores

5943 – Stationery stores

5944 – Jewelry stores

5945 – Hobby, toy, and game shops

5946 – Camera and photographic supply stores

5947 – Gift, novelty and souvenir shops

5948 – Luggage and leather goods stores

5949 – Sewing, needlework, and piece goods stores

5992 – Florists

5993 – Tobacco stores and stands

5994 – News dealers and newsstands

5999 – Miscellaneous retail stores

7011 – Hotels and motels

7032 – Sporting and recreational camps

7033 – Recreational vehicle parks and campsites

7922 – Theatrical producers (except motion picture) and miscellaneous theatrical services

7929 – Bands, orchestras, actors, and other entertainers and entertainment groups

7948 – Racing, including track operation

7991 – Physical fitness facilities

7992 – Public golf courses

7993 – Coin-operated amusement devices

7996 – Amusement parks

7997 – Membership sports and recreation clubs

7999 – Amusement and recreational services, not elsewhere classified

Pingback: UW Daily – January 2, 2019 | UW Daily